Background

At the start of July 2024, I had the opportunity to share my thoughts on blockchain technology and its potential impact in the short-term insurance vertical with South African Insurance companies (e.g. Alexander Forbes, Sanlam…) during a webinar organised by the Insurance Institute of South Africa (IISA). In this post, I summarise the talk, which was geared primarily for a business audience.

A Primer on Blockchain Technology

Blockchain technology is one of the building blocks of the “much acclaimed” fourth industrial revolution (“4IR”). If you know anything about me, I cringe at how the term 4IR is loosely thrown around, even in scenarios where it is just but simply vague (do you agree?). However, be that as it may, the 4IR is characterised by parallel development and interplay of independent technologies, each with world changing potential. These include cloud technology, blockchain, internet of things (telematics), artificial intelligence and machine learning, augmented reality, virtual reality, 3D printing etc. I like to stratify these across connectivity, data, and computational power; analytics and intelligence; human-machine interaction and advanced engineering. An over simplification is that the hardware and connectivity is becoming more advanced and accessible (the cost is decreasing), the time to market for new technology and products (hardware or software) is accelerating rapidly. For instance, ChatGPT took a week to get to a million users, where household applications such as Facebook or Instagram took months. Coming back to blockchain technology, it is one of the 4IR technologies and there is an expectation that this technology will become embedded in data exchanges and transactions in the near future.

So what exactly is blockchain technology? It is a shared, tamper-proof ledger (think database) that allows exchange of value and data between transacting parties.

Where then does blockchain – an emerging technology, meet insurance – an age-old and slow turning elephant? Although blockchain technology is largely associated with payments and financial innovation/chicanery, it provides a single source of truth across the multiple stakeholders in a value chain and unlocks automation via smart contracts, and efficiency gains from reduced intermediaries, which in the insurance value chain, contributes to Insurance 4.0 – digitally transformed insurance.

Insurance Value Chain

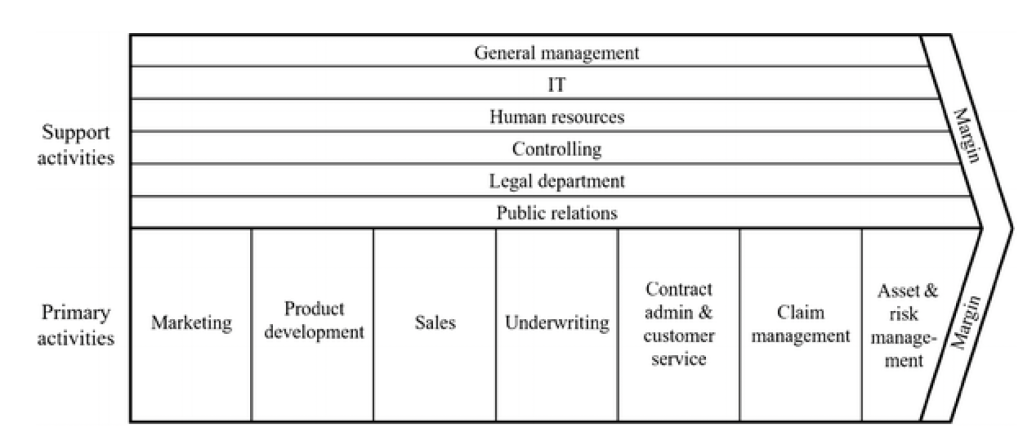

A good place to start with mapping the application of blockchain technology to insurance is by looking at a type-agnostic insurance value chain and its core activities which include sales, underwriting, contract administration, customer service, claims management, and risk management. This is shown below.

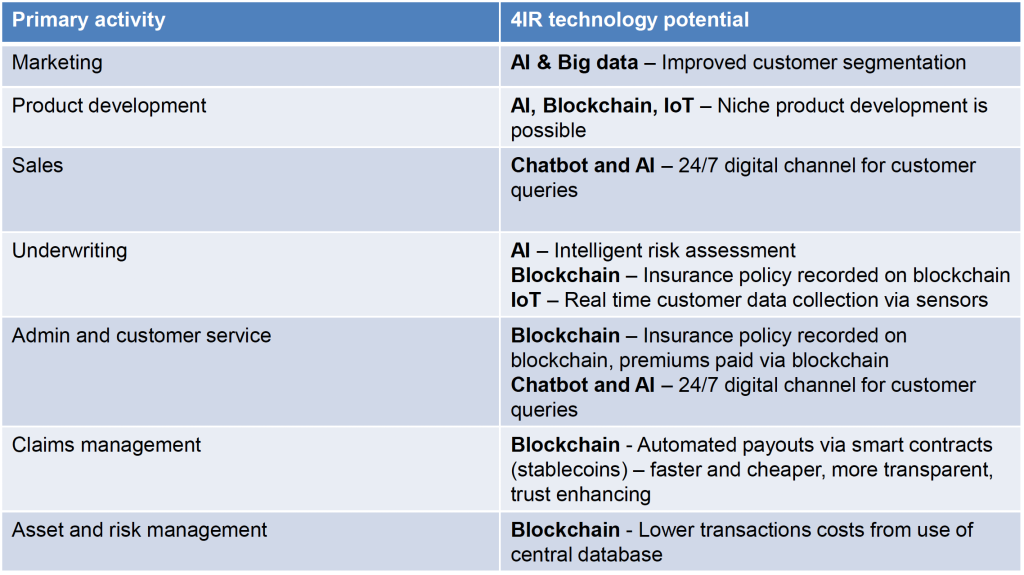

Further, the table below shows the primary activities of the insurance value chain, juxtaposed with corresponding 4IR technologies. It is worth noting that although the technology of interest is blockchain, these 4IR technologies go hand in hand, and can be applied to the value chain.

An example of blockchain in insurance

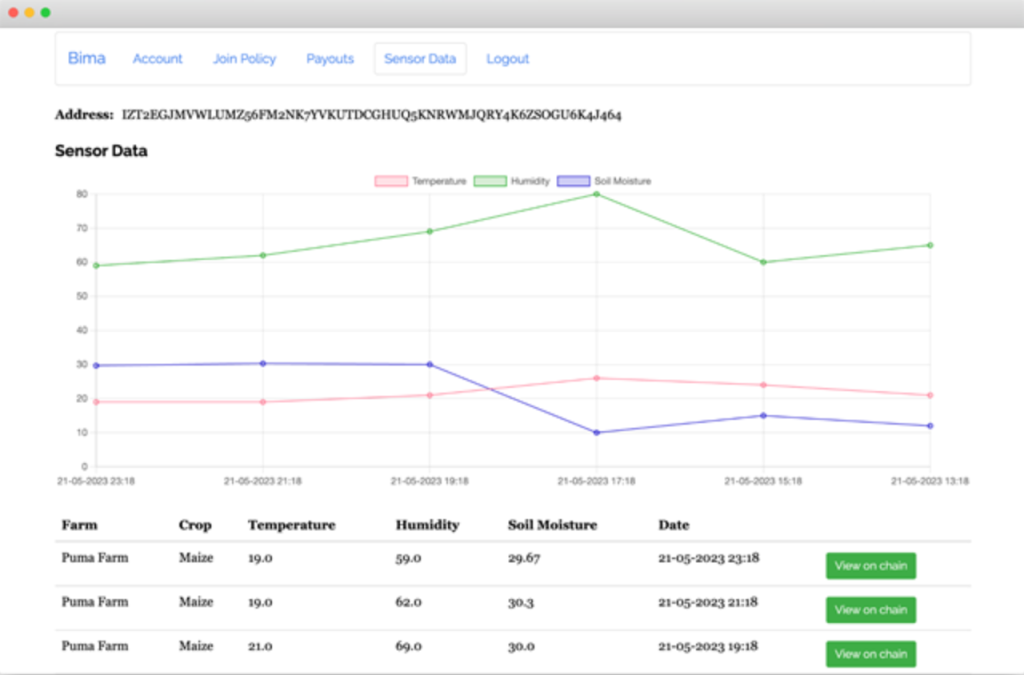

A promising application of blockchain technology in insurance is that of parametric insurance (also referred to as index insurance). A parametric type of insurance that pays out based on an index being triggered (via a strike event) instead of the traditional loss assessment triggered by a policy holder’s claim. An example of a weather index platform is Bima, a blockchain-enabled weather index platform for smallholder farmers in emerging markets.

This was developed by Tatenda Muvhu for his MPhil in Financial Technology thesis at the University of Cape Town. Bima utilises the Algorand blockchain and demonstrates (i) digitisation of an insurance policy management on chain; (ii) use of sensors to collect weather data (i.e. an oracle) and publish to blockchain; and (iii) automation of insurance payouts via blockchain. The insurance value-chain primary activities ticked by Bima include underwriting, contract administration and claims management.

Summary

Using 4IR technologies, and blockchain in particular, we can achieve the following in insurance

• Reduced information asymmetry.

• Improved customer segmentation and risk pooling.

• Increased efficiency.

• Increased trust & transparency.

To sum it up, insurance (in this case, short-term), the elephant in the room can turn faster, with the use of 4IR technologies – and more specifically, with blockchain providing a foundational and trusted single source of data and automation layer.