Is there any utility in crypto? This is a recurring question from crypto sceptics, who tend to argue that there is no utility outside of speculation. In this post, I give 2 examples in which crypto can be used to drive financial inclusion in emerging markets – particularly through the use of stablecoins (a cryptocurrency whose value is pegged to another asset class e.g. USD Coin (USDC) which is pegged to USD). Worldwide, there are 2 billion unbanked adults, and these fall into the financially excluded category. According to the South African National Treasury, financial inclusion is the provision and use of affordable and appropriate financial services by those segments of society where financial services are needed but not provided, or they are inadequately delivered.

Case 1 – Mandla Money SMS Wallet. Firstly, in September 2022, I gave a talk at the Apex Developer Conference (hosted by Ripple & XRP Ledger Foundation) in Las Vegas on how crypto-assets can drive financial inclusion in emerging markets (click here to watch). In my talk, I made reference to one of the innovative projects that I have been involved with – Mandla Money SMS Wallet – which is a digital wallet that allows users to receive, transact and store value using digital assets via SMS (text message), with no need for a smartphone or an internet connection. The Mandla Money SMS Wallet is built on top of the XRP Ledger (XRPL) which is a decentralized, public blockchain that is fast, energy efficient, and reliable. By making use of stablecoins issued on the XRPL, together with SMS technology which has been around for a while, anyone with a mobile device (including feature phones) has a means to access previously unavailable financial services.

Case 2 – Stellar Aid Assist. More recently (December 2022), Stellar Development Foundation announced the launch of Stellar Aid Assist which makes use of stablecoins to deliver digital aid at scale (e.g. in Ukraine). According to the Stellar team, cash-based interventions serve as a lifeline to millions worldwide in support of basic needs and Stellar Aid Assist – which is fast to deploy and rapidly scale to meet a moment of crisis – gets money into the hands of those who need it, quickly and at low cost.

Considering that there are 2 billion unbanked adults worldwide and that it is possible to send crypto-assets in low-tech environments (where there are no smartphones or internet access) using blockchains such as XRPL, Algorand & Stellar, it is clear that there is a real opportunity to drive financial inclusion in emerging markets through use of blockchain payment rails and stablecoins. So, is there any utility in crypto – I believe the answer is a resounding YES!

Outside of the Algorand events, I got to network with some of the TOKEN2049 crowd, enjoy the views from the top of the Marina Bay Sands and capped of the weekend with the F1 Marina Bay Night Race which did not disappoint.

Outside of the Algorand events, I got to network with some of the TOKEN2049 crowd, enjoy the views from the top of the Marina Bay Sands and capped of the weekend with the F1 Marina Bay Night Race which did not disappoint.

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email

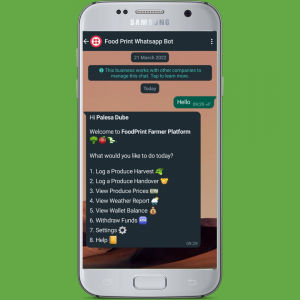

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email  At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free

At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like.

The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like. We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch

We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch  And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the

And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the