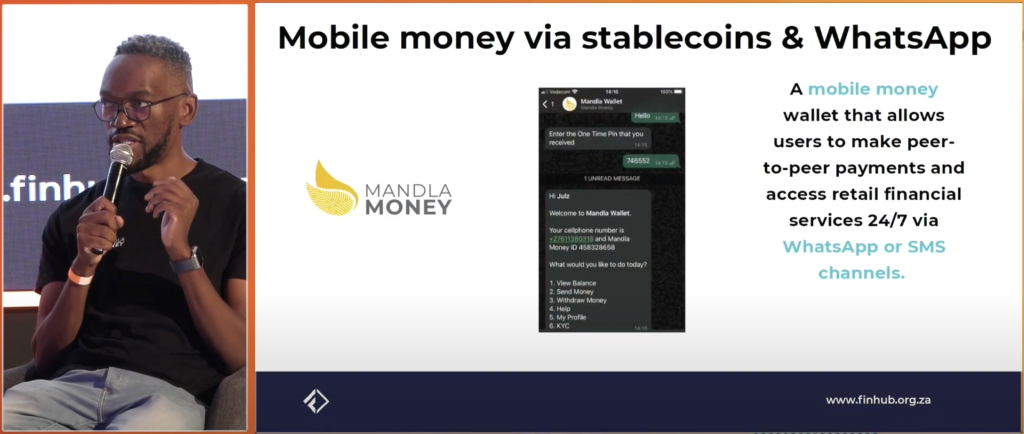

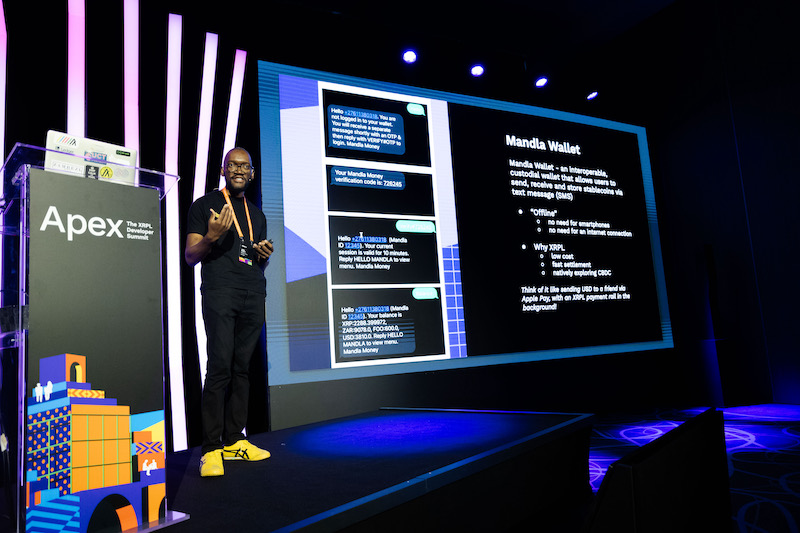

The annual XRP Ledger Apex 2025 conference hosted by Ripple took place from 10 – 12 June 2025 in Singapore. I attended the conference and took to the stage to showcase the integration of Ripple’s RLUSD stablecoin with the Mandla Money WhatsApp Wallet.

XRPL Apex is a conference that brings together builders, investors, partners of Ripple, the XRP Ledger and the broader blockchain technology ecosystem. This year’s conference was noteworthy for a few reasons. Firstly, Ripple used the event to showcase their recently minted enterprise-grade and regulated USD stablecoin, RLUSD. Secondly, Ripple also announced support for USDC, another USD stablecoin from the established player Circle – this was previously not natively available on the XRP Ledger. Thirdly, Ripple CEO, Brad Garlinghouse attended in person, and gave a positive outlook on the global crypto markets, and more importantly, the unfolding regulatory clarity in the USA and the rest of the world. And fourthly, the event being held in Singapore, where Ripple also has an office, signals the positioning of the country in the APAC region, as a key web3 market and gateway.

The major theme running throughout the event was that of stablecoins, and how they are about to have, if not already having their moment in the sun. What are stablecoins? A stablecoin is a representation of a government-issued currency (aka fiat) on the blockchain, which means it does not exhibit the volatility associated with cryptocurrencies, and simultaneously harnesses the low cost and high-speed properties of using blockchain as a payment rail. Personally, I am upbeat about the prospect of stablecoins, and would say that for blockchain and crypto utility, they are an application/use case with a a very clear product market fit! Two years ago (2022/2023), the question was central bank digital currencies (CBDC) vs stablecoins – it was not clear who the winner was going to be. Fast-forward to today, the CBDC conversation has largely died, and stablecoins are off to the races. Payment processing networks such as Visa and Mastercard are embracing stablecoins, to capitalise on the opportunity and not have their lunch eaten. Even banks like JPM are launching their own stablecoins, and there are even whispers of the launch of a USD stablecoin by a consortium of US banks. Beyond that, and perhaps a controversial take, but I can see a cannibalisation of DeFi applications by existing fintech and corporate institutions, offering DeFi like products behind walled gardens, and potentially winning a large market share because of the trust they already have in financial systems, and the customer base / distribution i.e. they have existing customers and control user onboarding.

But I digress, back to XRPL Apex. Given that stablecoins were the talk of the event, it was timely that Mandla Money’s WhatsApp wallet have added support for RLUSD, Ripple’s stablecoin. The Mandla Money team has also developed a bulk payments mechanism which enables micropayments to cellphone numbers at the click of a button (think distribution of relief aid, micropayments, etc.) At XRPL Apex, I took to the stage to talk about civil contingencies and cash voucher assistance, and gave a live demo of how Mandla Money’s Bulk Payments Web Portal and the WhatsApp Wallet can be used for distribution of cash assistance using the RLUSD stablecoin. The live demo, using real RLUSD on XRPL mainnet was a success, and was well received, especially considering that the pilots that Ripple has done with RLUSD in Kenya has been based on the Ethereum blockchain and not on XRPL.

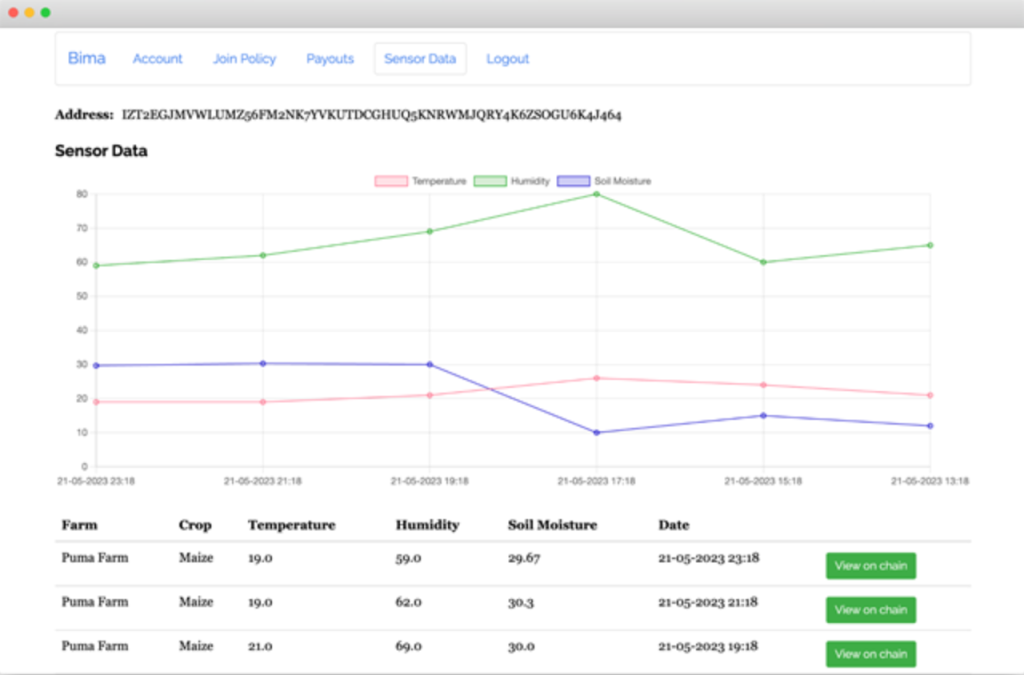

The Mandla Wallet supports various stablecoins that are available on the XRPL, including RLUSD, USDC, XSGD, USDB and EUROP.