Julian here, founder and CEO/CTO at FoodPrint. I’m excited to be sending out an update on how we are progressing as an AgTech startup. FoodPrint is a digital food supply chain platform connecting producers, buyers and consumers. At FoodPrint, we believe in short, sustainable and transparent supply chains – they are the answer to fairer and more sustainable food systems across the globe.

I’m especially excited about 2022 as we have been setting structure and process to the business – our team has grown and going forward we will send out regular updates such as these.

Funding

2021 was a good year for us. We won the Inqola FEED Innovation Prize (South Africa), which was followed by funding from the Algorand Foundation (Singapore). With this funding, we have been able to grow the team, build our WhatsApp chatbot and anchor our supply chain solution on the Algorand Blockchain to bolster trust in the supply chain data.

We are looking to raise some seed funding in the near future, if you are an investor and would like to chat, reach out here.

Team and Partnerships

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email here.

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email here.

Product Updates

WhatsApp Chatbot

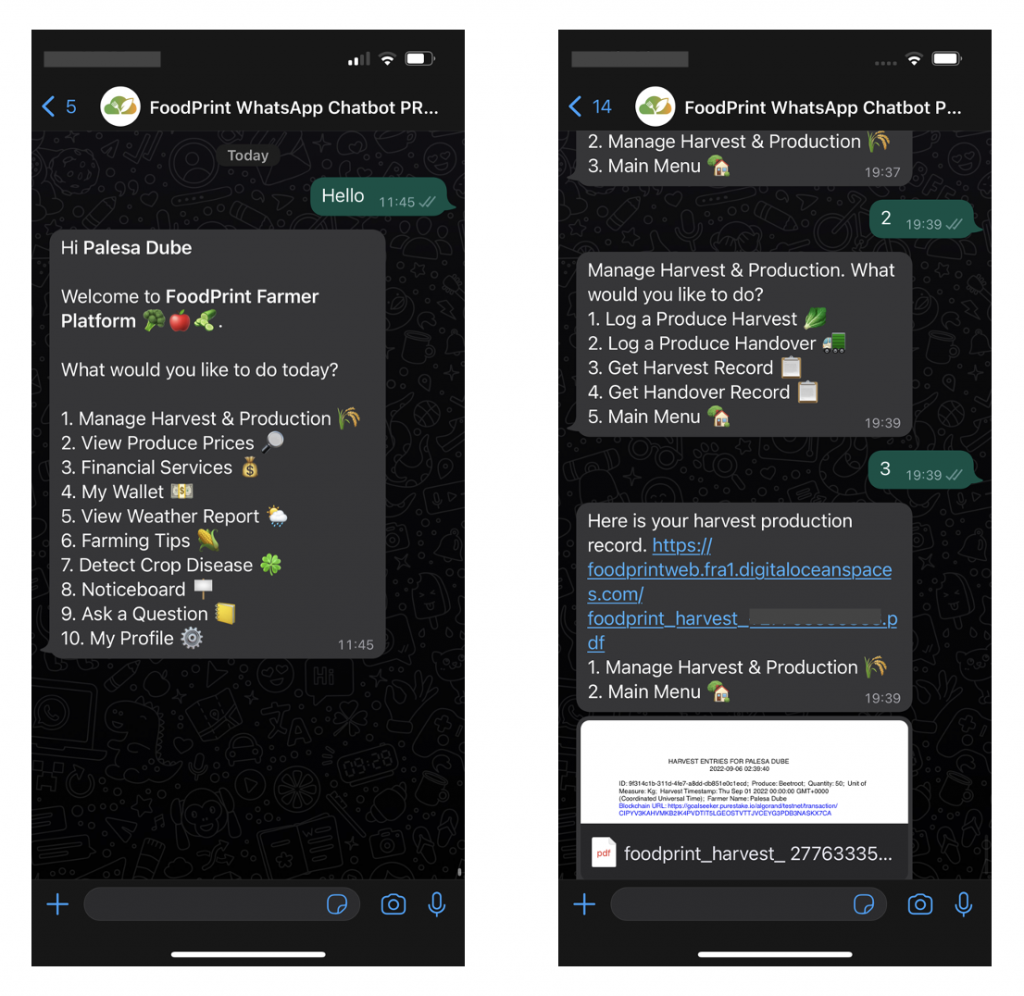

At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free

At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free

to use for smallholder farmers.

If you are a farmer, and would like to try out our chatbot, send a WhatsApp message to us here – https://wa.me/+27711463479 – and you will be notified once the chatbot is live.

FoodPrint QR Codes for Track and Trace

The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like.

The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like.

If you are a food retailer or business, and wish to provide a unique experience for your customers

(a digital touchpoint to drive consumer engagement), or a farmer wishing to tell the story about

your farm, get in touch here.

Harvest Box

We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch here.

We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch here.

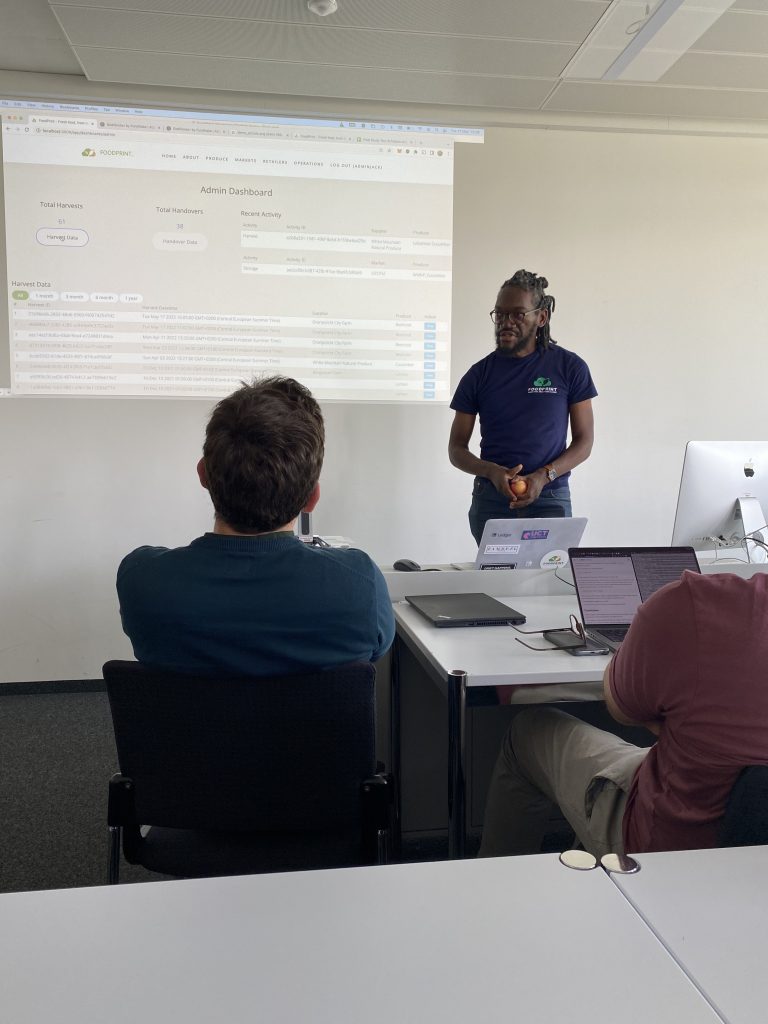

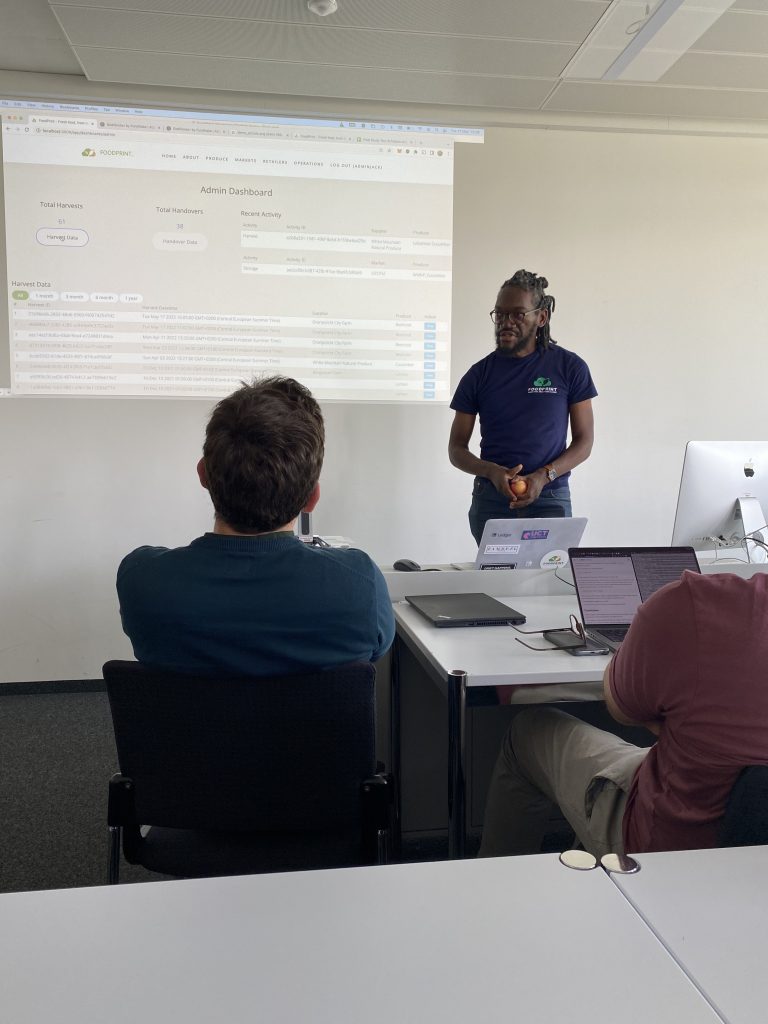

Visit to University of Zurich Blockchain Center

And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the University of Zurich Blockchain Center and University of Cape Town. This was well received and networks established – innovation and collaboration feed and build upon each other!

And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the University of Zurich Blockchain Center and University of Cape Town. This was well received and networks established – innovation and collaboration feed and build upon each other!

That’s all for now. Until the next update, eat your greens!

Julian Kanjere

Founder

https://www.foodprintlabs.com

Outside of the Algorand events, I got to network with some of the TOKEN2049 crowd, enjoy the views from the top of the Marina Bay Sands and capped of the weekend with the F1 Marina Bay Night Race which did not disappoint.

Outside of the Algorand events, I got to network with some of the TOKEN2049 crowd, enjoy the views from the top of the Marina Bay Sands and capped of the weekend with the F1 Marina Bay Night Race which did not disappoint.

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email

The FoodPrint team is growing, and in particular, our tech team is firing on all cylinders. We have an immediate need for a Community Manager – someone with expertise in agriculture, connections to farmers and cooperatives, entrepreneurship and community building. In addition, we are also seeking to partner with more AgriHubs/food cooperatives and bulk produce buyers/retailers – we would like them to hop on board as early adopters of our platform. If you can assist with either, drop us an email  At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free

At the end of 2021, we started work on our WhatsApp chatbot, and I am excited to say that we are almost ready to pilot this. Using our low-tech WhatsApp chatbot, farmers can register to the FoodPrint platform, and everytime they harvest and sell produce, they record this on the chatbot – creating a digital record (anchored on the blockchain) that links them to potential buyers and finance service providers (in future). The WhatsApp chatbot will be free The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like.

The FoodPrint platform also supports product-specific QR Codes for consumers to scan, and read the claims or the story behind the food they are buying or about to consume. Here is an example – scan with your mobile device – and see what a provenance record looks like. We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch

We have partnered with PEDI AgriHub in Philippi Cape Town, and are piloting a fresh produce harvest box in the Southern Suburbs of Cape Town! We are especially excited about this as this is an immediate way for us to add value to local farmers and provide the farmers they support with market access. The harvest box contains fresh, quality seasonal produce. If you would like to purchase a weekly fresh produce box, you can get in touch  And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the

And lastly, last month, I had the opportunity to share how FoodPrint is bringing blockchain technology to food supply chains in sub-Saharan Africa at a blockchain workshop in Zurich, arranged by the