The 2024 edition of the Interledger Summit by the Interledger Foundation took place in Cape Town, South Africa on the 26th and 27th of October 2024, with the theme – Bridging Worlds: Unleashing the Power of Interledger. The summit explored the ways of strengthening the United Nations initiative towards healthier digital public infrastructure (DPI), creating a more responsible financial ecosystem and and increasing economic participation for communities around the world, leveraging emerging technologies, including Interledger’s technology (e.g. Open Payments protocol).

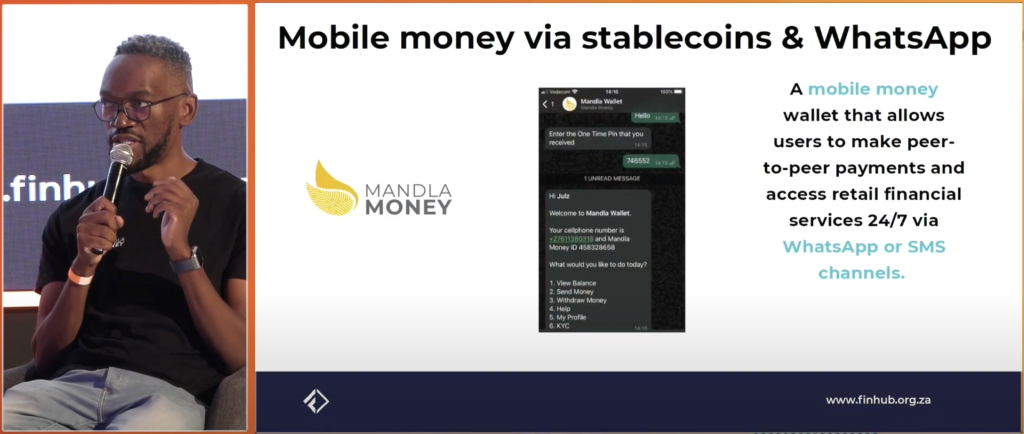

Representing Mandla Money, I participated in a panel discussion with Dr Allan Davids (Director of the University of Cape Town’s (UCTs) Financial Innovation Hub, and fellow UCT MPhil in Financial Technology alumnus, Kungela Mzuku, in which we explored how to drive digital payments and digital inclusion in informal economies, and unpacked why the use of cash remains prevalent in South Africa (watch on YouTube). Official statistics suggest that financial inclusion in South Africa is high (~80%). However, this statistic is somewhat misleading, if viewed out of context because it does not account for whether an individual is underbanked or not. An underbanked individual will have access to a cheque account but not access to credit, and the cheque account typically has a low frequency of use on a monthly basis (e.g. once a month to draw all the cash, pay a single transaction fee and then use cash throughout the month). The underbanked phenomenon is key to understanding why cash remains prevalent and mobile money has been slow to take off.

Cash is Convenient

Cash remains king because it is convenient for consumers. A consumer that withdraws cash after receiving their salary knows that it is universally accepted by merchants. Merchants, informal communities typically accept cash and card payments, but they often will impose minimum spend requirements for card payments in order to offset the high costs of transacting with Point-of-Sale (PoS) devices. Another reason why consumers withdraw all of their cash in one go, post pay day is to avoid paying high service fees from repeated bank account usage. One bulk withdrawal, one service charge, and no further service charges when transacting with cash.

Mobile Money – South Africa vs Zimbabwe

Tackling the elephant in the room, why has mobile money been slow to take off in South Africa, especially compared to Kenya (M-PESA) and Zimbabwe (EcoCash)? There are variations of mobile money in South Africa, including MTN’s MoMo and FNB’s eWallet, eWallet is arguably the defacto leader at present. One can argue that South Africa’s financial services system is developed and sufficiently distributed – payment systems are accessible via different channels – mobile, online, ATMs, retail supermarkets etc. – and a variety of payment methods are accepted by merchants – cards, cash, QR codes. In fact, I would argue that a lot of the retail FinTech innovation has been focused on convenience and not a fundamental enablement of payments e.g. Zapper & SnapScan. Looking at the case of Zimbabwe, between 2007 and 2009, Zimbabwe suffered severe hyperinflation, which resulted in cash shortages (and cash withdrawal limits at ATMS). This, and a lack of trust in the financial system created a conducive environment for mobile money, and the birth of EcoCash. As the old adage goes, necessity is the mother of invention, and at present, South Africa does not have strong enough endogenous push factors towards mobile money as Zimbabwe (and Kenya) did.

Mobile Money v2 and Mandla WhatsApp Wallet

Instead of asking why mobile money has not taken off in South Africa (or other sub-Saharan / emerging economies), perhaps the better question to ask is what financial services solutions can we come up with that allow consumers and merchants to transact digitally, whilst leveraging existing infrastructure and public spaces. We know that hardware is improving and becoming cheaper (Moore’s law). Connectivity is improving, low-cost smartphones are available, open banking APIs are becoming more common.

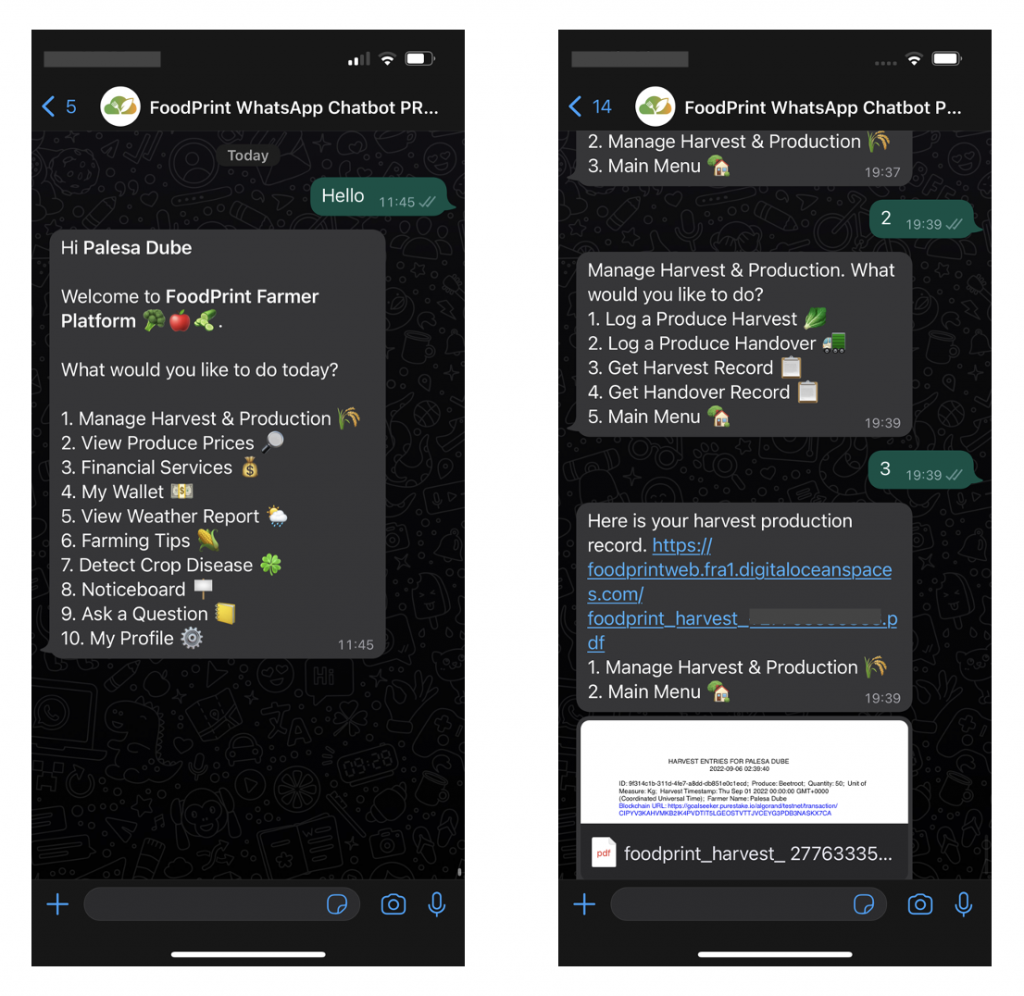

At Mandla Money, our approach to this has been enabling peer-to-peer payments and access to retail financial services via WhatsApp, stablecoins and open banking APIs. At the end of the day, making payments should not feel too different from sending a message (case in point, WhatsApp), and it should not matter which mobile network operator you are with!

Panel discussion – Towards an inclusive cashless society